From 2020 to 2024, China’s artificial stone industry underwent significant transformation driven by technological improvements, market expansion, and shifts in global supply chains. As one of the world’s largest producers and exporters of artificial stone—particularly quartz slabs—China’s performance during this period offers valuable insight into industry competitiveness, production capacity, and long-term growth potential.

Let’s break it down in simple terms. We’ll look at the industry not just with numbers, but through the lens of a business owner. Is it profitable? Is it growing? What are the challenges?

1. Profitability: The Squeeze is On

Gone are the days of easy money. The profitability of China’s artificial stone industry has tightened.

- Thinner Margins: The market is crowded. With so many manufacturers, competition is fierce. The easiest way to win a contract? Lower your price. This price war has squeezed profit margins for everyone.

- Stubborn Costs: While selling prices drop, costs haven’t. Raw materials like resins and quartz sand see price fluctuations. More importantly, strict environmental regulations mean higher costs for pollution control and equipment. You’re earning less per sale while spending more to produce.

The Bottom Line: The industry is still making money, but the high-profit “gold rush” is over. Success now depends on smart management and tight cost control.

2. Growth Speed: From Sprint to a Brisk Walk

The industry is still growing, but the pace has changed.

- The Sprint (2020-2021): After the initial pandemic phase, there was a burst of pent-up demand. Construction and renovation projects exploded, leading to rapid growth.

- The Brisk Walk (2022-2024): The slowdown in the real estate sector and broader economic shifts have applied the brakes. Growth is now steadier and more moderate.

3. Barriers to Entry: The Invisible Wall

What This Means: The market isn’t shrinking; it’s just maturing. You can’t just open a factory and wait for orders. You need to actively find new customers and explore new markets to grow.

Starting a new artificial stone factory today is much harder than it was a decade ago.

- The Money Wall: It’s not just about buying a few machines. To start a compliant, competitive factory now requires a significant investment—often millions of dollars—in proper equipment and environmental safeguards.

- The Knowledge Wall: Anyone can produce low-quality stone. The high-end market, however, demands superior technology for better durability, more realistic patterns, and larger slab sizes. This technical know-how takes years to develop.

- The Trust Wall: Distributors and contractors prefer to work with established brands that guarantee consistent quality. A new, unknown factory will struggle to build a reliable sales network from scratch.

The Reality: The barrier is high. The industry is consolidating, leaving smaller, weaker players behind.

4. Risk: Navigating the Minefield

Running an artificial stone business comes with significant risks.

- The Green Risk: Environmental compliance is the biggest threat. Stricter policies mean that a single violation can lead to massive fines or a full shutdown. It’s a constant concern.

- The Cash Flow Risk: Dealing with large property developers or construction companies often means accepting long payment cycles. Waiting 90 or 120 days for payment can strangle a company’s cash flow.

- The Sameness Risk: If your products look like everyone else’s, your only competitive tool is price. This traps you in a cycle of low profits and high vulnerability.

The Lesson: Successful business owners aren’t just salespeople; they are risk managers, especially when it comes to the environment and finances.

5. Industry Cycle: A New Chapter

Every industry has a life cycle. China’s artificial stone sector is now in a mature “shakeout” phase.

The initial boom is over. The market is now testing companies, pushing out those that are inefficient or non-compliant. The survivors are those competing on quality, brand strength, and service.

This is a healthy, though painful, transition. It leads to a more stable and sophisticated industry.

The Final Word

From 2020 to 2024, China’s artificial stone industry has transformed. It’s no longer a wild frontier but an established marathon.

For new entrants, the path is steep and requires careful planning. For existing players, the key to survival is internal strength: operational efficiency, innovative products, and impeccable risk management.

Understanding these indicators helps you see not just the stone, but the solid foundation needed to build a lasting business.

About Us

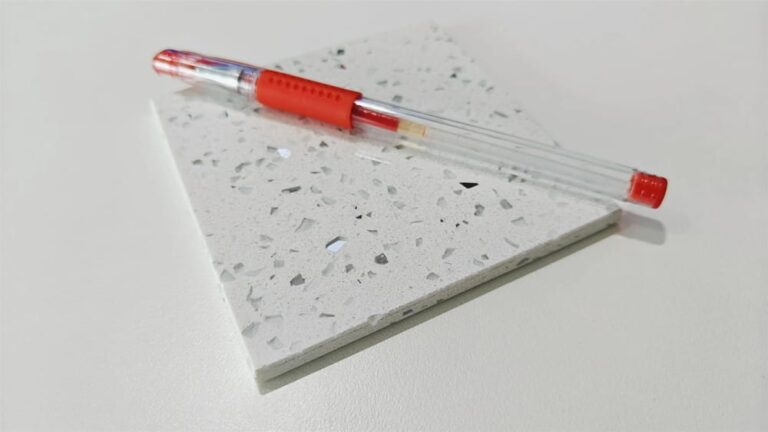

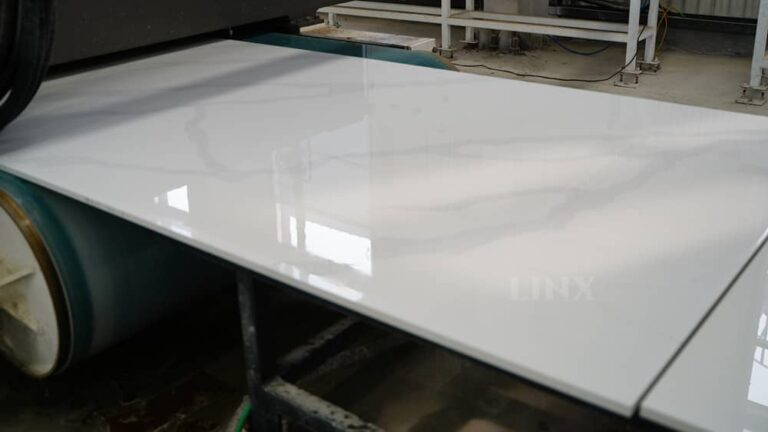

We stand out as a leading manufacturer of artificial quartz stone slabs in China, proudly operating our own factory. We specialize in supplying top-quality quartz slabs to esteemed brand-owners, wholesalers, distributors, and fabricators worldwide.

Our products include quartz stone Calacatta series, Carrara series, Fine grain & Diamond series, Pure Colors series, Unique Patterns series, JADE series, and Printed Quartz Stone.

Thickness: 15mm, 18mm, 20 mm, 30 mm

Standard Size: 3200x1600mm(126×63 inch)

Biggest Size: 3500x2000mm(137.8×78.4 inch)

Surface: Polished/Matte

Trade Manager: Hero Gegal

Phone: +86 150 5425 3293

WhatsApp: +86 150 5425 3293

References: