The artificial stone industry has undergone rapid modernization in recent years, driven by technological innovation, diversified market demand, and increasingly globalized supply chains. Understanding how manufacturers produce artificial stone, how companies source raw materials, and how products enter domestic and international markets is essential for businesses seeking to optimize operations or expand globally.

This article provides an in-depth analysis of the production, procurement, and distribution models that define today’s artificial stone industry.

1. Production Models in the Artificial Stone Industry

Production processes for artificial stone—such as quartz slabs, engineered marble, and solid surfaces—vary depending on product type, technology level, and factory scale. However, several core models are widely adopted across the industry.

1.1 Traditional Batch Production

Traditional batch production involves manufacturing artificial stone in fixed lots. Factories schedule production based on orders or inventory targets.

Characteristics include:

- Lower equipment automation

- Longer production cycles

- Increased labor dependency

- Suitable for small to medium factories

This model offers flexibility but may struggle to support large-scale, consistent output.

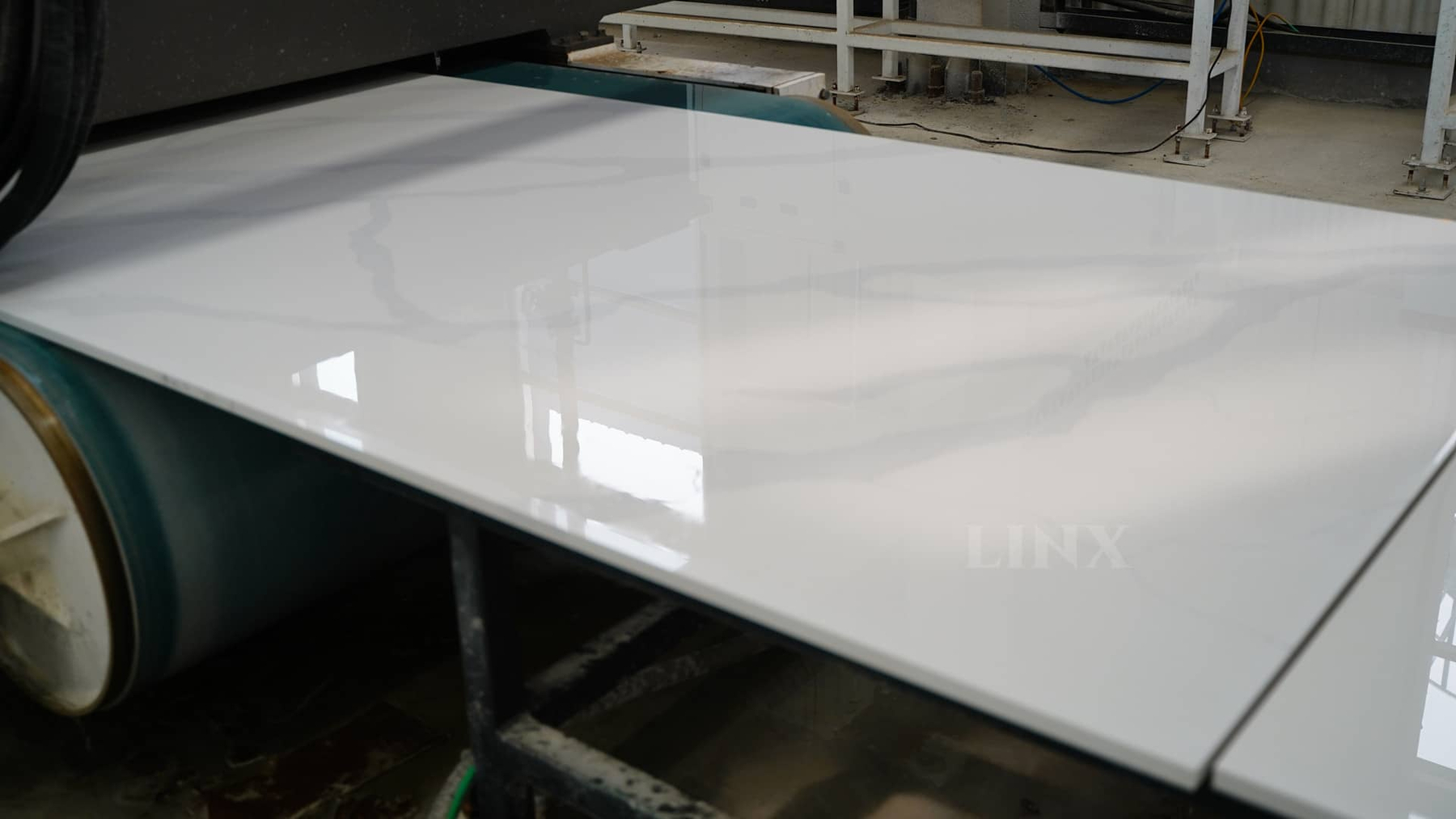

1.2 Automated Continuous Production Lines

With advances in machinery and resin technology, many manufacturers now use automated lines—especially for quartz stone.

Key advantages:

- High output and stable quality

- Reduced labor costs

- Real-time quality control

- Strong scalability for large orders

Medium and large factories increasingly rely on continuous production to remain competitive in both domestic and export markets.

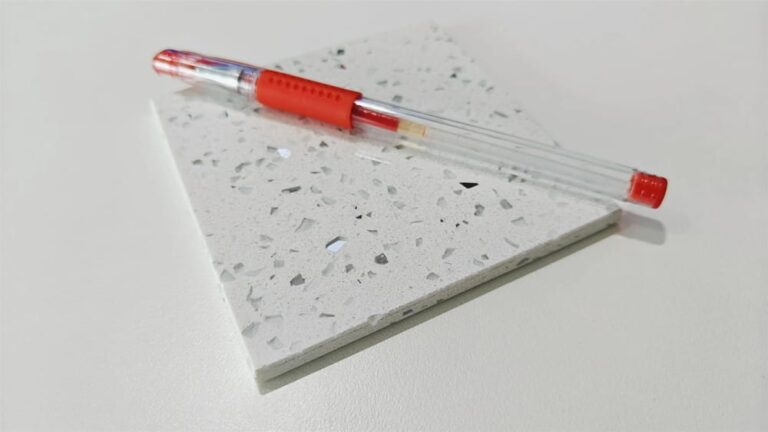

1.3 Customized and High-End Production

To meet the growing demand for premium countertops and unique architectural materials, some producers shift toward customization.

Features include:

- Tailor-made colors, patterns, and textures

- Special sizes or thicknesses

- Integration of advanced pigments or recycled materials

This model helps factories target niche and high-margin market segments.

2. Procurement Models in the Artificial Stone Industry

Procurement directly affects product quality, cost structure, and competitive advantage.

The artificial stone industry typically relies on the following sourcing models:

2.1 Centralized Procurement

Large manufacturers often implement centralized purchasing to negotiate better prices for:

- Quartz sand

- Resins

- Pigments

- Catalysts

- Packaging materials

Centralized procurement reduces costs through volume discounts and ensures material consistency.

2.2 Multi-Supplier Procurement

To avoid supply interruptions and maintain stable production, many companies adopt a multi-supplier approach.

Benefits include:

- Lower supply chain risk

- More competitive pricing

- Flexibility in choosing materials with different quality grades

This model is essential for factories exporting to global markets where consistency is critical.

2.3 Local + International Hybrid Procurement

Some raw materials—such as high-purity quartz sands and specialized resins—may perform differently depending on origin.

Therefore, manufacturers often combine domestic sources with imported materials to achieve optimal performance in:

- Color stability

- Mechanical strength

- UV resistance

This hybrid strategy supports premium product lines aimed at high-end markets such as North America, Europe, and Australia.

3. Distribution and Sales Models in the Artificial Stone Industry

Once products leave the factory, they enter complex distribution networks spanning domestic and global markets.

3.1 Direct Sales Model

Factories sell directly to:

- Construction companies

- Kitchen countertop fabricators

- Real estate developers

- Overseas importers

Direct sales shorten the supply chain and increase profitability.

3.2 Distributor and Dealer Networks

Many manufacturers rely on regional distributors to expand market coverage.

Advantages:

- Strong local market penetration

- Reduced marketing burden on manufacturers

- Faster logistics for end buyers

This model is common for domestic sales and mature export markets.

3.3 OEM and ODM Models

OEM/ODM production is popular among global brands that prefer outsourcing manufacturing while controlling brand identity.

- OEM: Manufacturer produces slabs under the client’s brand

- ODM: Manufacturer provides design + production

This model allows factories to grow export volume without building their own brand overseas.

3.4 E-Commerce and Cross-Border Platforms

Digital sales channels now influence the industry’s growth.

Examples include:

- B2B platforms like Alibaba, Made-in-China

- Corporate websites optimized for SEO

- Social media marketing (YouTube, Pinterest, TikTok, Instagram)

Factories increasingly combine digital marketing with traditional distribution to reach global customers more efficiently.

Conclusion

The artificial stone industry continues evolving alongside advancements in manufacturing technology, globalization, and shifting consumer preferences.

Understanding the production, procurement, and distribution models helps businesses optimize supply chains, improve product quality, control costs, and expand into international markets.

For manufacturers and exporters—especially those in competitive markets like quartz slabs—strategic improvements in these three areas can significantly enhance long-term growth and brand competitiveness.

About Us

We stand out as a leading manufacturer of artificial quartz stone slabs in China, proudly operating our own factory. We specialize in supplying top-quality quartz slabs to esteemed brand-owners, wholesalers, distributors, and fabricators worldwide.

Our products include quartz stone Calacatta series, Carrara series, Fine grain & Diamond series, Pure Colors series, Unique Patterns series, JADE series, and Printed Quartz Stone.

Thickness: 15mm, 18mm, 20 mm, 30 mm

Standard Size: 3200x1600mm(126×63 inch)

Biggest Size: 3500x2000mm(137.8×78.4 inch)

Surface: Polished/Matte

Trade Manager: Hero Gegal

Phone: +86 150 5425 3293

WhatsApp: +86 150 5425 3293

References: